Do you think you’re getting a raw deal on your car insurance? You’re not alone. Car insurance premiums are climbing faster than ever, and it’s not just bad luck. Here are 17 shocking reasons your insurance is becoming a serious financial burden and what you need to know to protect your wallet.

1. Skyrocketing Accident Rates

Image Credit: Shutterstock / AntonSAN

Accidents are becoming alarmingly frequent. In 2020 alone, the National Highway Traffic Safety Administration (NHTSA) reported a 7.2% increase in traffic fatalities. More wrecks mean more claims, and guess what? Insurers pass those costs directly onto you. Brace yourself—your premiums are going up because more people are driving like maniacs.

2. Distracted Driving Epidemic

Image Credit: Shutterstock / Daxiao Productions

Distracted driving, fueled by our addiction to smartphones, is wreaking havoc on the roads. The Insurance Information Institute warns that texting and other distractions are major culprits in rising accident rates. So, while you’re distracted by your phone, you’re also paying the price in higher insurance premiums. How’s that for a wake-up call?

3. Soaring Medical Expenses

Image Credit: Shutterstock / ARTFULLY PHOTOGRAPHER

Medical costs are out of control, and your insurance premiums are feeling the pinch. With health spending expected to rise at an average annual rate of 5.4% through 2028, insurance companies are raising premiums to keep up. So, when you’re hit with a big medical bill, remember—it’s not just the hospitals that are charging more; your insurer is too.

4. Exorbitant Vehicle Repair Costs

Image Credit: Shutterstock / Drazen Zigic

Modern cars come packed with high-tech features that are a nightmare to repair. The Bureau of Labor Statistics notes vehicle repair costs have risen by around 3% annually over the past decade. Every time you get a fender bender, the cost to fix your car is soaring, and your premiums reflect that reality.

5. Rampant Litigation

Image Credit: Shutterstock / SynthEx

More accidents mean more lawsuits. The American Bar Association reports an ongoing rise in personal injury claims. Legal fees and settlements are driving up costs, which insurers eagerly pass along to you. You pay all those lawyers’ fees every time you renew your policy.

6. Natural Disasters Wreaking Havoc

Image Credit: Shutterstock / Ronnie Chua

Extreme weather like hurricanes and wildfires are not just destroying homes — they’re wrecking cars, too. The Insurance Information Institute highlights that claims from natural disasters are climbing, especially in disaster-prone states like California and Texas. As these disasters become more frequent, so do your insurance premiums.

7. The Fraud Epidemic

Image Credit: Shutterstock / SaiArLawKa2

Insurance fraud is draining billions from the industry every year. The National Insurance Crime Bureau estimates that fraud accounts for about 10% of the property and casualty insurance industry’s losses. Guess who’s footing the bill for all this deception? That’s right—you.

8. Higher Coverage Limits

Image Credit: Shutterstock / jd8

Insurance companies offer higher coverage limits to provide better protection, but this comes at a steep price. More coverage means higher premiums. Policies with enhanced liability limits are particularly affected. So, while getting more protection, you also pay a lot more for it.

9. Costly New Car Safety Features

Image Credit: Shutterstock / metamorworks

New car safety features like adaptive cruise control and automatic braking are supposed to reduce accident severity but come with a hefty repair price tag. Repairing or replacing these advanced systems costs more, and insurers aren’t shy about passing those costs on to you.

10. Traffic Congestion Nightmare

Image Credit: Shutterstock / ymgerman

Urban traffic congestion is more than just a daily annoyance—it’s a premium killer. Areas with heavy traffic, like New York and California, see more accidents. More accidents in congested areas translate to higher premiums. Your daily commute is literally costing you more.

11. COVID-19 Driving Changes

Image Credit: Shutterstock / Song_about_summer

The pandemic altered driving patterns dramatically. Fewer cars on the road initially, followed by a surge in reckless driving and speeding, are now driving up accident rates. As traffic resumes, you’re stuck paying higher premiums due to this chaotic shift in driving habits.

12. Rising Uninsured Motorists

Image Credit: Shutterstock / NONGASIMO

The number of uninsured drivers is climbing in some states. With about one in eight drivers uninsured, insured drivers end up covering the shortfall. The Insurance Research Council highlights this growing problem, which means your premiums are higher to offset the costs of uninsured drivers.

13. Credit-Based Insurance Scores

Image Credit: Shutterstock / REDPIXEL.PL

Your credit score is impacting your insurance premiums more than ever. Poor credit can mean significantly higher premiums. While some states like California, Hawaii, and Massachusetts ban this practice, many others use it to inflate your rates. It’s yet another way insurers are exploiting your financial history.

14. State Regulations Driving Up Costs

Image Credit: Shutterstock / Andrey_Popov

Insurance regulations vary wildly by state, and those with stricter coverage requirements often have higher premiums. States like New Jersey and Michigan, with their stringent regulations, see higher insurance costs. Knowing your state’s requirements could mean the difference between saving or wasting money.

15. Rising Underwriting Costs

Image Credit: Shutterstock / Korawat photo shoot

The costs of underwriting insurance policies have surged. Assessing and managing risk is getting pricier, and guess what? Those increased costs are reflected in your premiums. You’re paying for the inefficiencies and increased expenses of insurance companies.

16. Inflation Impact

Image Credit: Shutterstock / PERO studio

Inflation isn’t just impacting your grocery bill—it’s also hitting your insurance premiums. The Consumer Price Index shows a steady rise in overall costs, and insurance is no exception. As everything gets more expensive, so do your insurance rates.

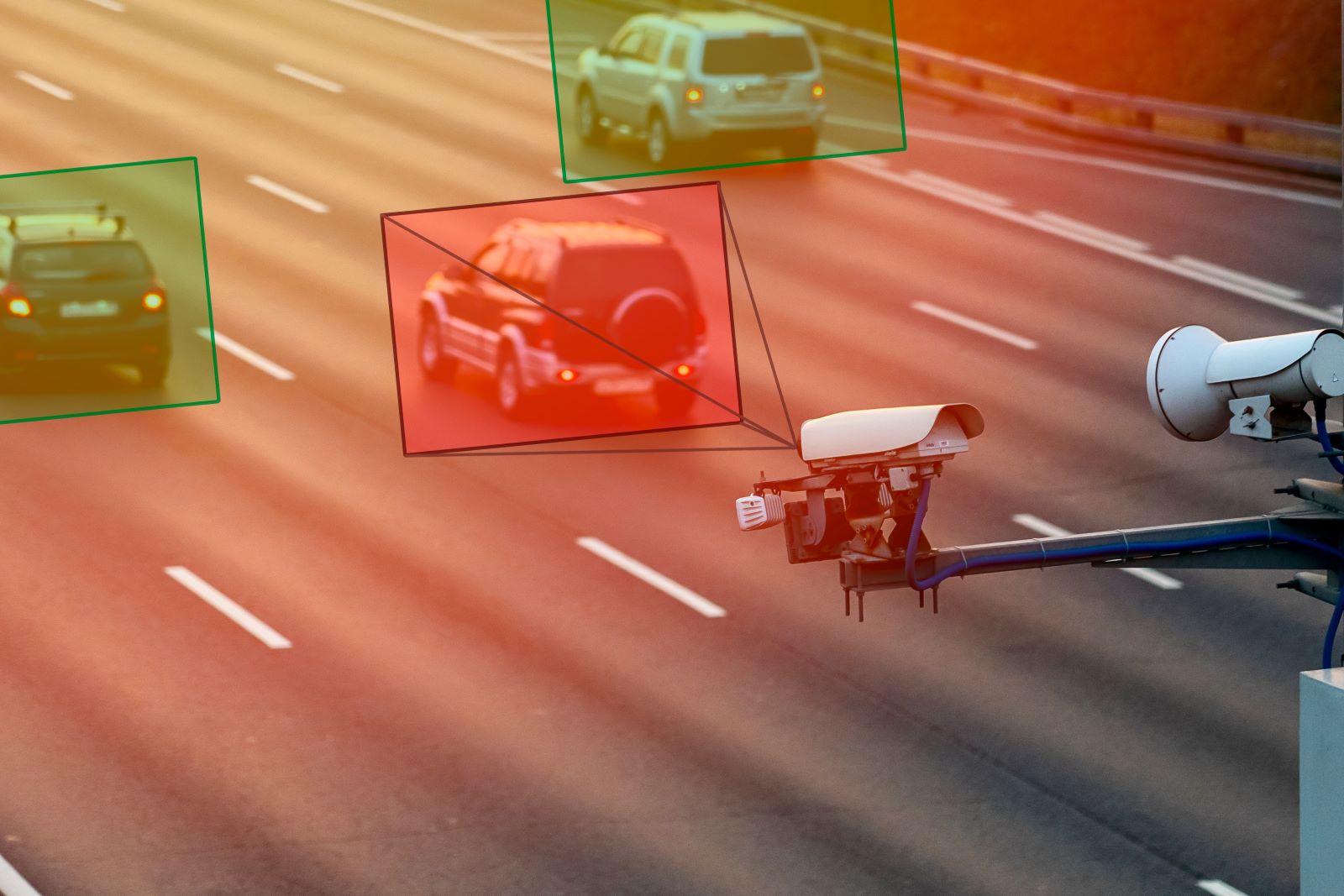

17. Advanced Data Analytics

Image Credit: Shutterstock / Jokiewalker

Insurance companies are using sophisticated data analytics to determine your risk, which often results in higher premiums. Your specific risk profile, assessed through complex algorithms, could lead to increased rates. The more data they collect, the more they’re likely to charge you.

Arm Yourself with Knowledge

Image Credit: Shutterstock / Ground Picture

Understanding the reasons behind rising car insurance premiums can help you make informed decisions and potentially save money. Don’t just accept higher rates—shop around, assess your options, and take control of your insurance costs. Your wallet will thank you.

Police Magnet: 7 Cars That Guarantee You’ll Get Pulled Over

Image Credit: Shutterstock / sirtravelalot

Driving certain cars can make you more noticeable to law enforcement, even if you’re abiding by all the rules. Are you driving one of these “police magnets”? Here are seven cars that seem to attract more police attention than others. Police Magnet: 7 Cars That Guarantee You’ll Get Pulled Over

The Classic Cars That Were Total Clunkers

Image Credit: Pexels / Pixabay

Nostalgia has a funny way of making the past seem better than it was, especially when it comes to cars. But here’s the hard truth: some of those “classic” cars your dad raves about were real clunkers. Here’s a closer look at why some of those so-called “classics” weren’t all they were cracked up to be. The Classic Cars That Were Total Clunkers

The Worst U.S. Cars Ever Made: A Retro List

Image Credit: Pexels / Be The Observer

The U.S. auto industry has produced some incredible vehicles, but not every model was a hit. Here’s a look back at 16 of the worst cars ever made in the U.S., each infamous for its own unique flaws. The Worst U.S. Cars Ever Made: A Retro List

Featured Image Credit: Shutterstock / Halfpoint.

The content of this article is for informational purposes only and does not constitute or replace professional advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.

The images used are for illustrative purposes only and may not represent the actual people or places mentioned in the article.