Your car and insurance company may be monitoring you far more closely than you realize. While advancements in technology promise convenience and safety, they also mean your every move could be tracked, analyzed, and used against you. Here’s an unsettling look at 18 ways your car and insurer could be keeping tabs on you—and why you should be concerned.

1. Telematics Devices

Image Credit: Shutterstock / Frame Stock Footage

Telematics devices installed in your car track your driving habits—speed, braking patterns, and mileage. Insurers use this data to adjust your premiums, often without your explicit consent. A 2021 study by the Insurance Research Council found that 64% of drivers didn’t realize these devices could lead to rate hikes based on their driving behavior.

2. Onboard Diagnostics (OBD) Ports

Image Credit: Shutterstock / BLKstudio

The OBD port in your car allows mechanics and insurers to access detailed information about your vehicle’s performance and error codes. This data includes your driving style, which can be used to adjust insurance rates. Research by the National Insurance Crime Bureau revealed that over 30% of drivers are unaware their OBD data can be used to influence insurance premiums.

3. GPS Tracking

Image Credit: Shutterstock / Andrey_Popov

Many modern vehicles come with GPS systems that track your location, speed, and routes. Insurance companies may use this data to verify claims or adjust premiums. According to a 2022 report by the Insurance Information Institute, GPS tracking data is increasingly used to settle disputes and increase premiums based on driving patterns.

4. In-Car Cameras

Image Credit: Shutterstock / GOLFX

Built-in cameras, meant for safety features like lane-keeping and collision avoidance, can capture video footage of your driving. This footage can be accessed by insurers to determine fault in accidents. A 2023 study by the Center for Automotive Research highlighted that 45% of drivers are unaware their in-car cameras can be used against them in claims.

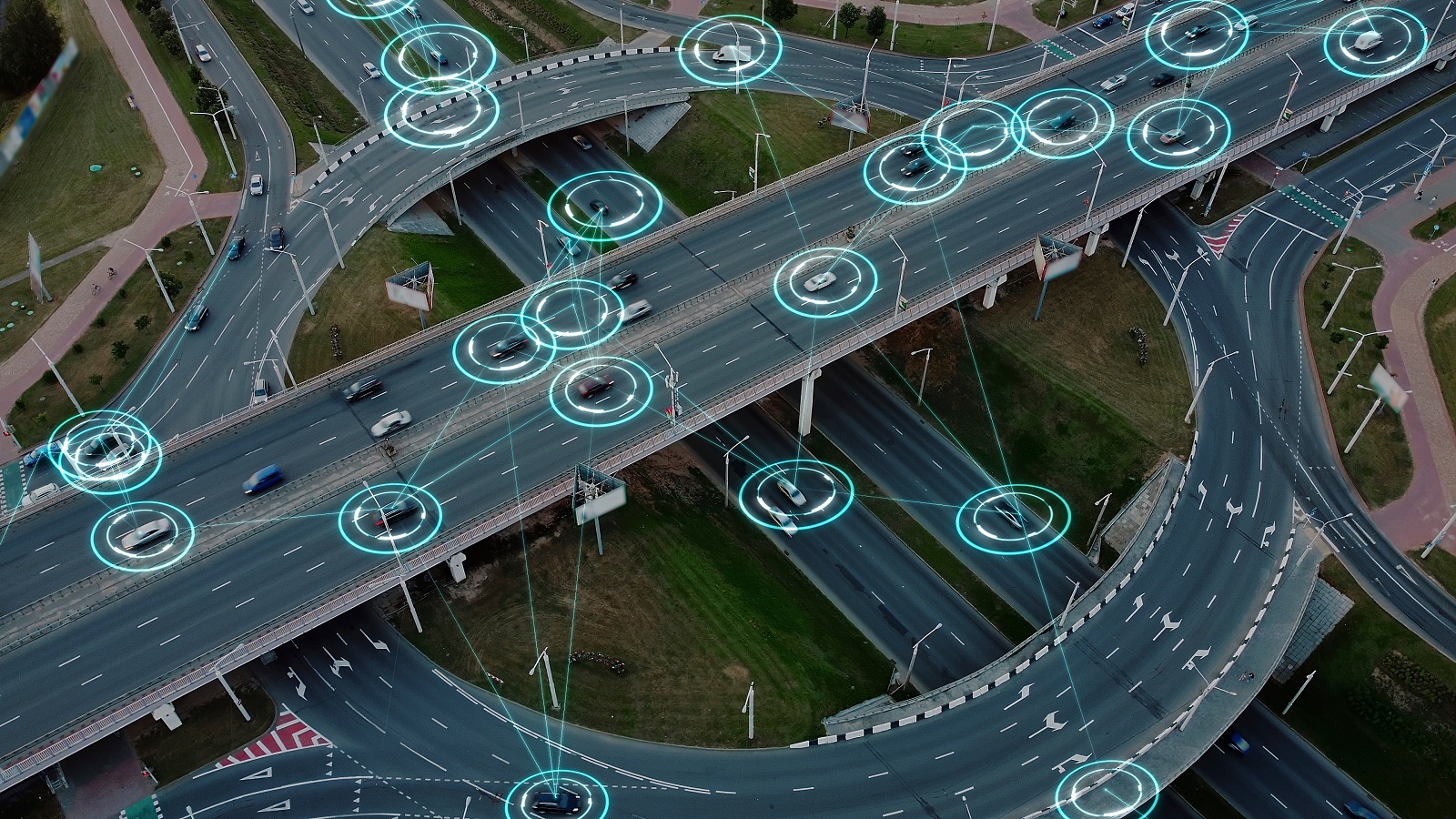

5. Connected Car Systems

Image Credit: Shutterstock / AlinStock

Connected car systems, such as OnStar and Sync, collect data on your driving habits and vehicle health. Insurers might access this information to set rates or deny claims. The 2021 Automotive Data Privacy Report found that 78% of drivers don’t realize their connected car data is being used to adjust insurance costs.

6. Driver Assistance Systems

Image Credit: Shutterstock / Gorodenkoff

Features like adaptive cruise control and collision avoidance rely on sensors that monitor your driving patterns. This data can be shared with insurers to assess risk. A recent survey by Consumer Reports showed that 62% of drivers are concerned about the data collected by these systems being used to raise insurance premiums.

7. Insurance Mobile Apps

Image Credit: Shutterstock / ShotPrime Studio

Insurance companies often provide mobile apps that track your driving behavior, including speed and braking. This data can be used to determine your rates and eligibility for discounts. Research from the University of Michigan Transportation Research Institute found that 53% of users are unaware their driving data is being constantly monitored by these apps.

8. Mileage-Based Insurance

Image Credit: Shutterstock / speedphotos

Policies that adjust premiums based on mileage use devices to track how many miles you drive. Excessive mileage can lead to higher rates, reflecting increased risk. According to a 2022 analysis by J.D. Power, 48% of drivers don’t realize that high mileage can lead to significant increases in insurance premiums.

9. Driving Behavior Scores

Image Credit: Shutterstock / Rido

Insurers use driving behavior scores derived from telematics data to set your premium rates. These scores reflect your driving habits, including speed and braking. A 2021 study by the Insurance Research Council found that 70% of drivers are unaware how their driving behavior scores affect their insurance rates.

10. Crash Detection Systems

Image Credit: Shutterstock / StockPhotosLV

Modern cars with crash detection systems automatically notify emergency services and insurers about the accident. This data can be used to assess fault and claim validity. According to the National Highway Traffic Safety Administration, 25% of drivers are surprised that their crash data can be used against them in insurance claims.

11. Insurance Claim Surveillance

Image Credit: Shutterstock / Song_about_summer

Insurers use various surveillance techniques, including in-car data analysis, to verify the details of claims. This can involve reviewing GPS data, camera footage, and telematics information. The 2022 Insurance Fraud Report revealed that 41% of drivers are unaware their claims are subject to such intense scrutiny.

12. Driver Profiling

Image Credit: Shutterstock / PV productions

Insurance companies create detailed profiles based on your driving data, influencing rates and coverage. This profile includes information on your driving style and habits. A 2023 study by the Insurance Research Council found that 59% of drivers are concerned about the potential misuse of their driving profiles.

13. Vehicle Tracking by Law Enforcement

Image Credit: Shutterstock / Frame Stock Footage

Law enforcement can access GPS data from your car for investigations. This means that even if you’re not breaking the law, your location and driving history could be monitored. The 2021 Civil Liberties Report found that 37% of drivers are uneasy about the potential for law enforcement access to their vehicle’s tracking data.

14. Usage-Based Insurance Policies

Image Credit: Shutterstock / NONGASIMO

Usage-based insurance (UBI) policies adjust premiums based on driving behavior and mileage. This means your insurance costs can fluctuate based on how you drive. According to a 2022 report by the Insurance Information Institute, 64% of drivers don’t fully understand how UBI policies impact their insurance rates.

15. Privacy Policy Agreements

Image Credit: Shutterstock / PanuShot

When you sign up for insurance or use connected car features, you agree to privacy policies that detail data collection practices. Often, these agreements are complex and lengthy, leading many drivers to overlook critical details. Research by the Privacy Rights Clearinghouse indicates that 72% of drivers are concerned about how their data is used under these agreements.

16. Insurance Fraud Detection

Image Credit: Shutterstock / Andrey_Popov

Insurers use data analysis to detect fraud, including discrepancies in driving data and claim histories. This sophisticated technology can sometimes lead to legitimate claims being flagged. A 2023 study by the Insurance Fraud Bureau found that 29% of drivers feel their data might be misinterpreted, leading to wrongful claim denials.

17. Third-Party Data Sharing

Image Credit: Shutterstock / Miha Creative

Insurance companies may share your data with third parties, including repair shops and automotive manufacturers. This data sharing can lead to privacy concerns and unexpected changes in your coverage. The 2022 Data Privacy Report highlighted that 47% of drivers are concerned about their data being shared without their consent.

18. Data Security Concerns

Image Credit: Shutterstock / Andrey_Popov

As vehicles and insurance companies collect more data, the risk of data breaches increases. Personal information and driving data are valuable targets for hackers. According to a 2022 cybersecurity study, 52% of drivers are worried about the security of their personal and driving data being compromised.

A Little Paranoia

Image Credit: Pexels / Andrea Piacquadio

The next time you get behind the wheel or update your insurance policy, remember that your data is being watched and analyzed. Understand what data is collected, how it’s used, and what it means for your privacy and insurance costs.

2024’s Most Anticipated Car Releases: What’s Coming Soon

Image Credit: Shutterstock / canadianPhotographer56

If you love cars, 2024 is shaping up to be an exciting year. New models are rolling out with more power, better tech, and some fresh designs that could change the game. Here’s the scoop on the top cars hitting the streets soon. 2024’s Most Anticipated Car Releases: What’s Coming Soon

21 Mods That Make Your Car Illegal

Image Credit: Shutterstock / macondo

Car modifications can enhance style and performance, but not all modifications are legal. Here are 21 illegal car modifications that can get you in trouble with the law across various states. 21 Mods That Make Your Car Illegal

10 American Classic Cars That Define a Generation

Image Credit: Shutterstock / Krisz12Photo

American classic cars are symbols of their eras, each telling a story of its time and capturing the essence of car culture. Here are ten classics that defined generations. 10 American Classic Cars That Define a Generation

Featured Image Credit: Shutterstock / Prostock-studio.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.